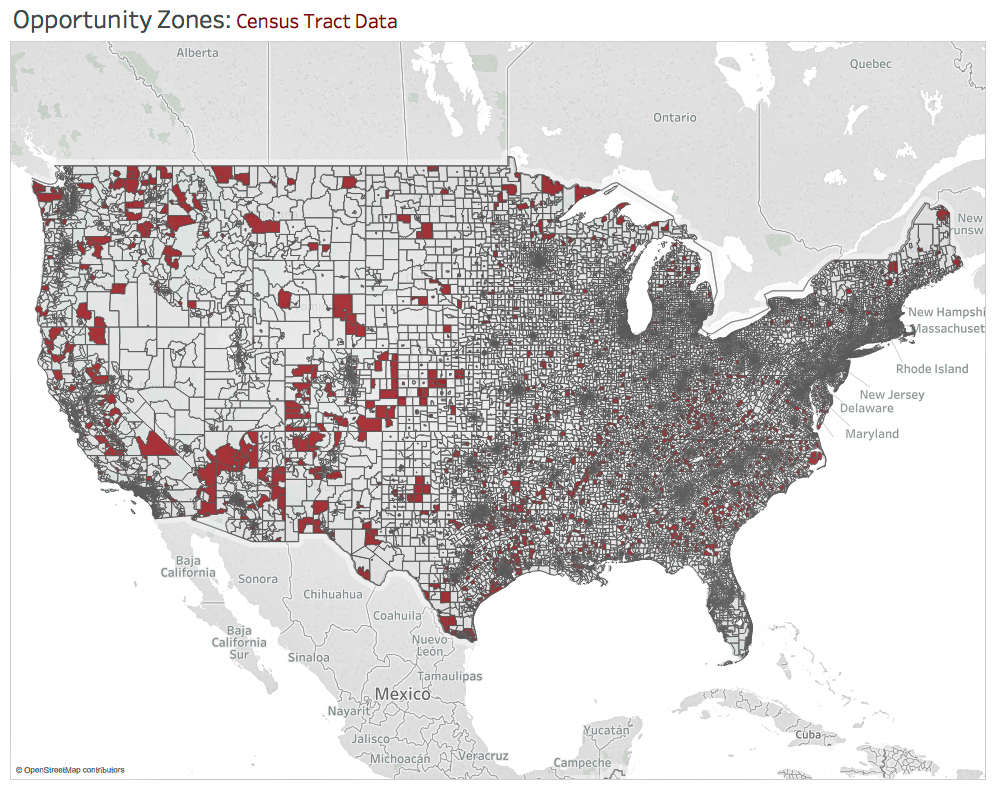

Opportunity Zones were established in the Tax Cuts and Jobs Act of 2017 as an innovative way to encourage investment in low-income communities across the U.S. This policy offers investors tax incentives for qualifying investments in designated Opportunity Zones. This site provides resources and research related to this tax incentive.